what percentage of taxes are taken out of paycheck in nc

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

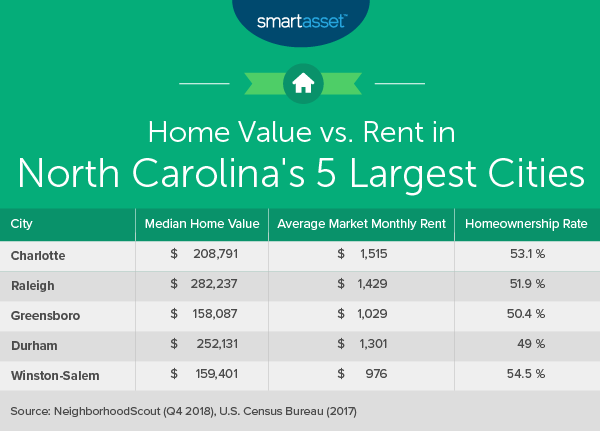

The median household income is 52752 2017.

. Some deductions from your paycheck are made. Minimum Wage in North Carolina in 2021. On the other hand when you are self-employed you pay both portions of these taxes ie a total of 153.

No state-level payroll tax. Current FICA tax rates. Based on economic conditions an employers tax rate could be as low as 0060 or as high as 5760.

95-258 a 1 - The employer is required to. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. If you are self employed or otherwise need to file form NC-40 reference. The Calculator will help you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

The state tax year is also 12 months but it differs from state to state. The current rate for. Both employee and employer shares in paying these taxes.

Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The income tax is a flat rate of 499. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525.

North Carolina Income Taxes. Raleigh NC 27609 Map It. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

However you can claim an adjustment or deduction for a portion of. The current tax rate for social security is 62 for the employer and 62 for the employee or. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when. That rate applies to taxable. Some states follow the federal tax.

This can make filing state taxes in the state relatively. North Carolina moved to a flat income tax beginning with tax year 2014. For tax year 2021 all taxpayers pay a flat rate of 525.

To use the calculator. What is the percentage that is taken out of a paycheck. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Hourly non-exempt employees must be paid time and a. Take Your 2019 Standard Deduction. Social Security Tax.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is. What is NC withholding tax.

The North Carolina income tax has one tax bracket with a maximum marginal income tax of 525 as of 2022. What percentage of taxes are taken out of payroll. Just enter the wages tax withholdings and other information required.

Each employers payroll for the last three fiscal years as of July 31 of the current year.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

The Cost Of Living In North Carolina Smartasset

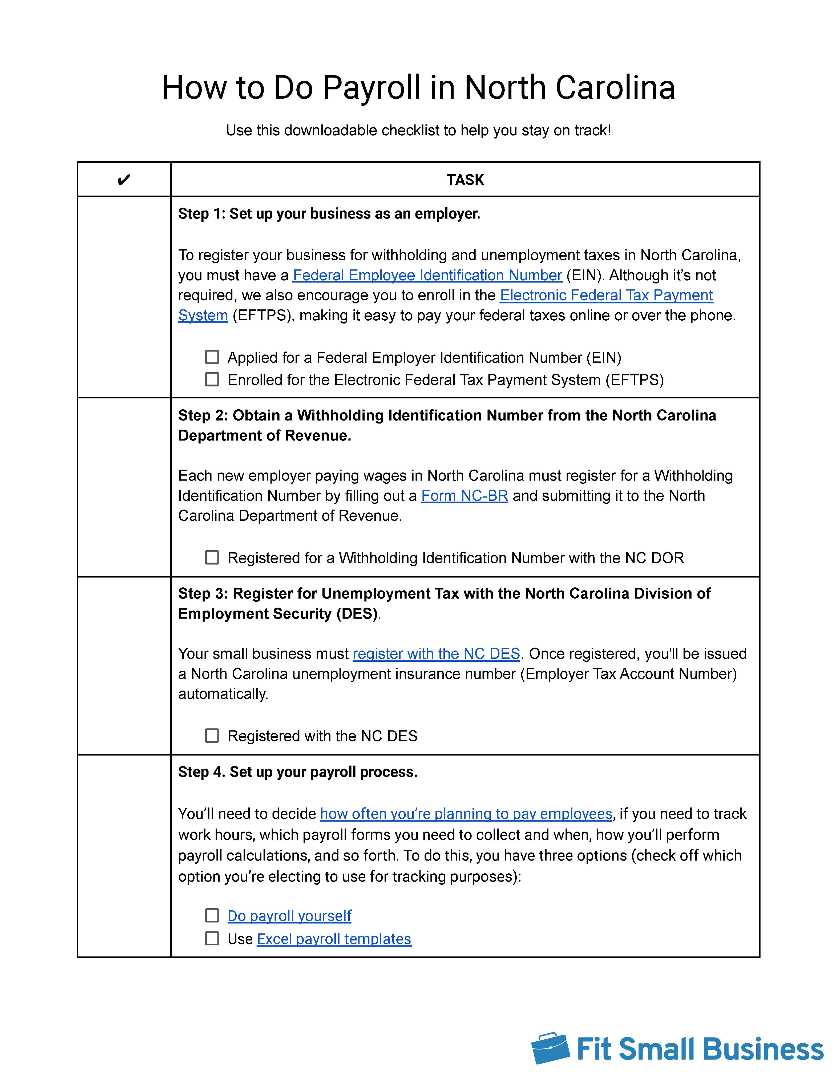

How To Do Payroll In North Carolina Detailed Guide For Employers

How The Flat Tax Revolution Of 2022 Was Sparked In North Carolina

Federal Withholding Tax Table 2022

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Tax Manager Salary In Charlotte Nc Comparably

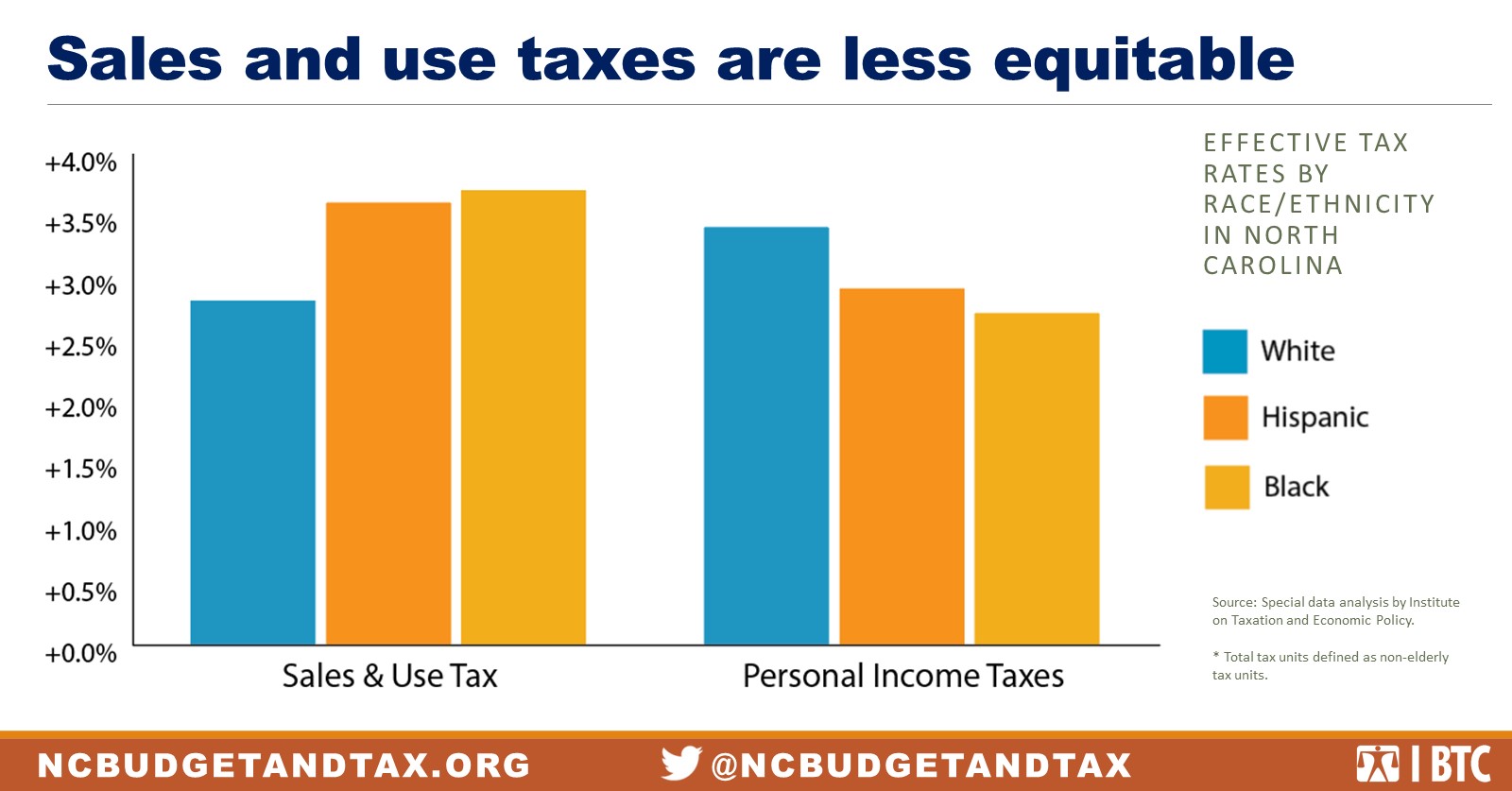

State Tax Policy Is Not Race Neutral North Carolina Justice Center

North Carolina Income Tax Calculator Smartasset

North Carolina Paycheck Calculator Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Income Tax Calculator Smartasset

How The Tax Cuts And Jobs Act Is Helping North Carolina Americans For Tax Reform

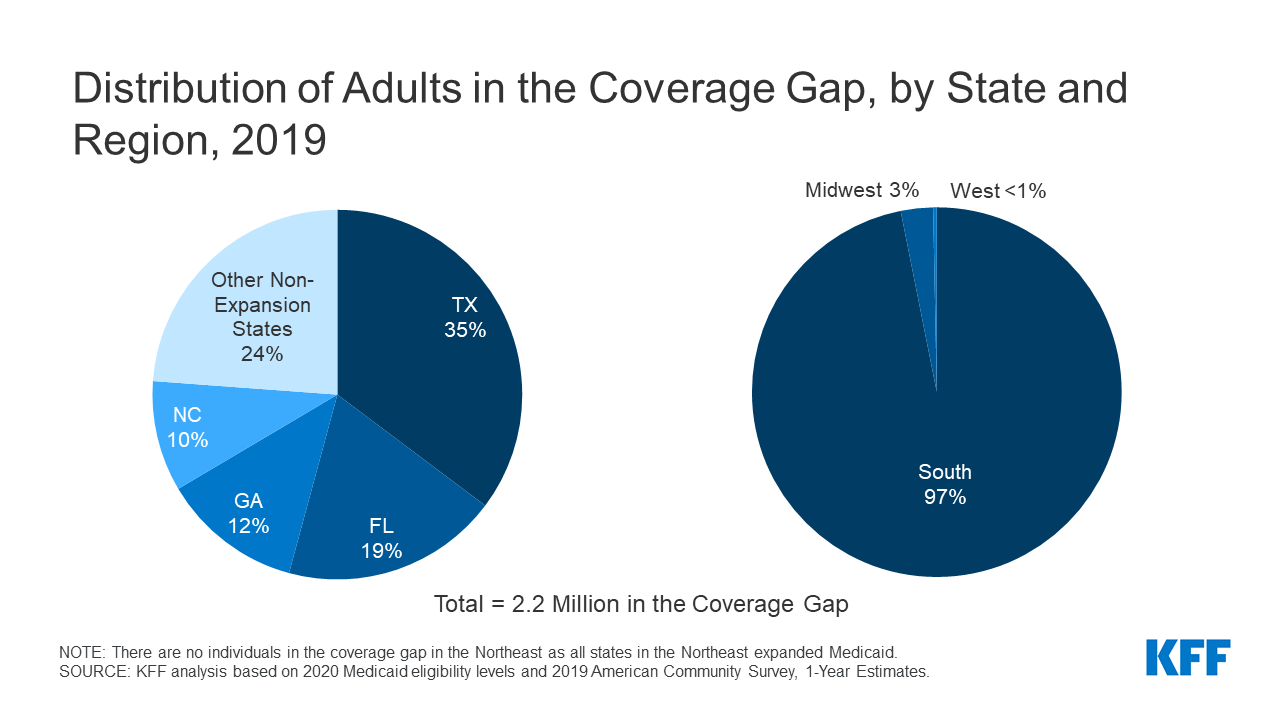

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

2021 N C Small Business Handbook By Business North Carolina Issuu

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation